ATM withdrawals will become more expensive from May 1, RBI has increased the charge

Withdrawing Money From ATM Will Be Expensive From May 1: From today, May 1, some important financial changes are going to be implemented across the country. Which will affect the entire citizenry of the country. The most prominent change is the revised framework for ATM transaction charges besides which the government has further enhanced its campaign to streamline the rural banking system by integrating regional banks.

ATM withdrawal fees:

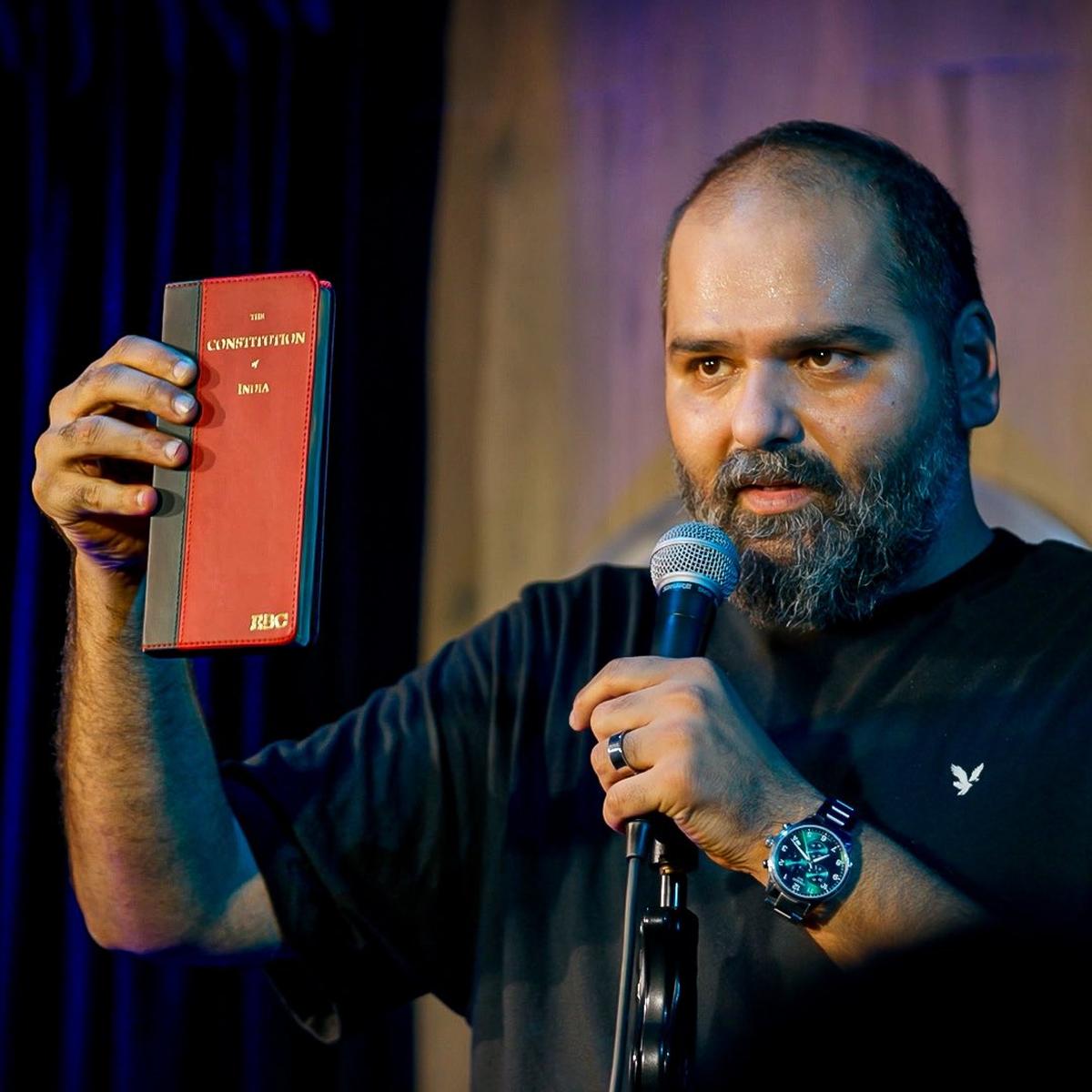

Customers will have to pay a little more when withdrawing money from ATMs after the Reserve Bank of India (RBI) approved a hike in ATM interchange fees. ATM interchange fees are the amount that one bank pays another bank for using its services.

Now, the customers will be charged Rs 23 per transaction after they exhaust their free monthly limit, which is an increase from the current charge of Rs 21 per transaction.

Now, permission is provided to customers:

Earlier this month, the campaign `One State-One RRB (Regional Rural Bank)’ was launched by the Finance Ministry in 11 states, whereupon 15 RRBs from these 11 states will be merged into one.The scheme will be implemented from May 1 and aims to achieve better operational efficiency and cost rationalization.

Read More: Which state’s Chief Minister gets the highest salary in India?

A notification from the Ministry of Finance said, “The Central Government hereby provides for the merger of the said Regional Rural Banks into a single Regional Rural Bank with effect from May 1, 2025, which shall have such constitution, property, powers, rights, interests, authorities and facilities and such responsibilities, duties and responsibilities as may be specified therein.”

With this fourth phase of the merger of Regional Rural Banks (RRBs), their number will be reduced from the current 43 to 28.

Savings account and FD interest rates

From May 1, RBL Bank savings account holders will get monthly interest instead of quarterly. According to an email sent by the bank, the maximum interest rate on savings accounts is 7 percent, depending on the amount deposited. “Interest will be calculated and accrued daily based on the closing balance in your account and will be paid/credited to your account every month,” the email said.

ALSO READ: Benefits of digital ration card