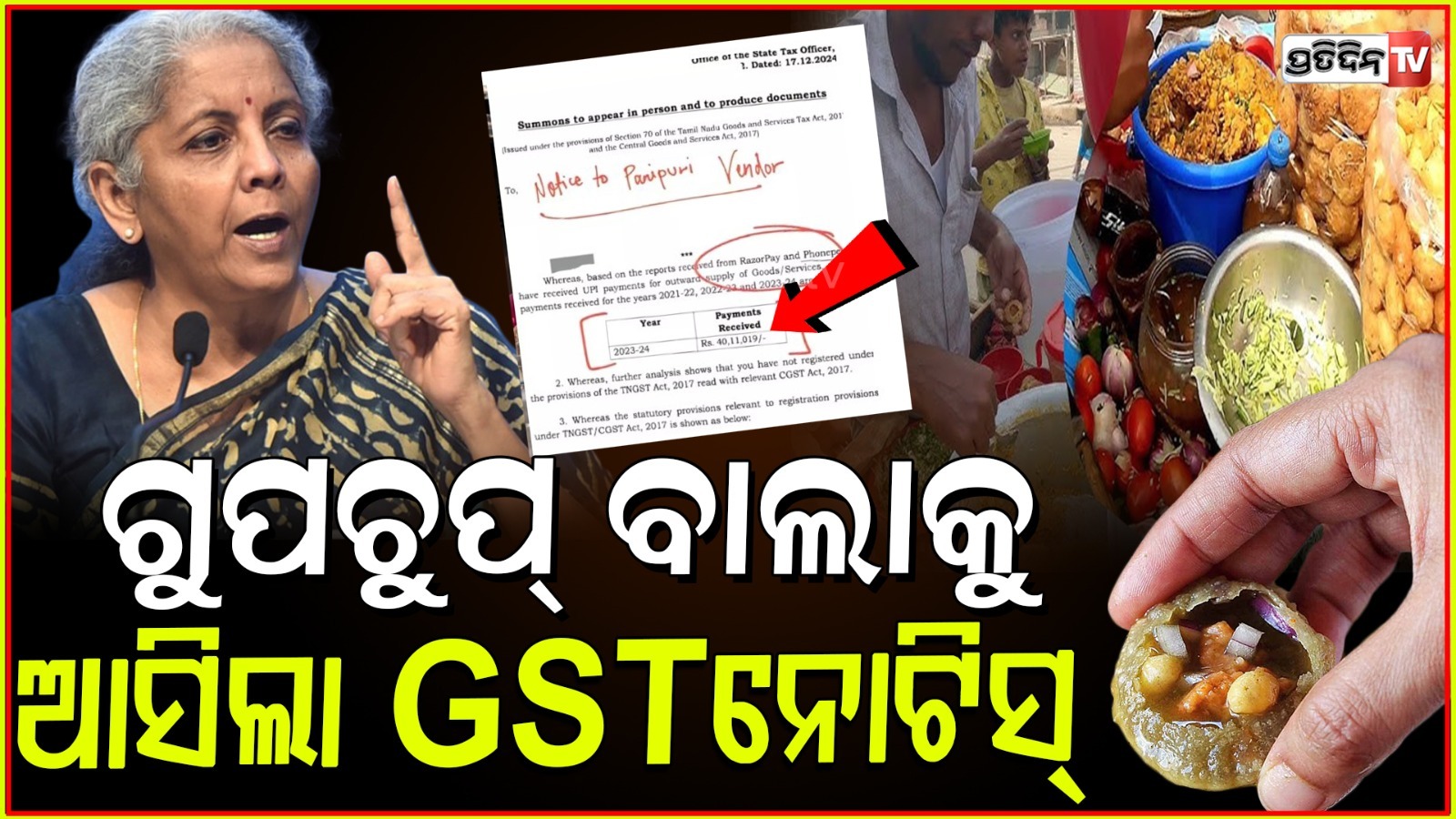

Pani puri wala gets GST notice

Pani puri wala gets GST notice , know how much his annual income .can u believe that a panipuri wal gets gst notice . what do you think how much his income ?

Pani Puri vendors are in the spotlight after receiving GST notices for crossing Rs 40 lakh in online transactions, sparking a flurry of amusing reactions on social media. While street vendors are usually exempt from taxes due to their small-scale operations, the rise of digital payments has brought them into the limelight.

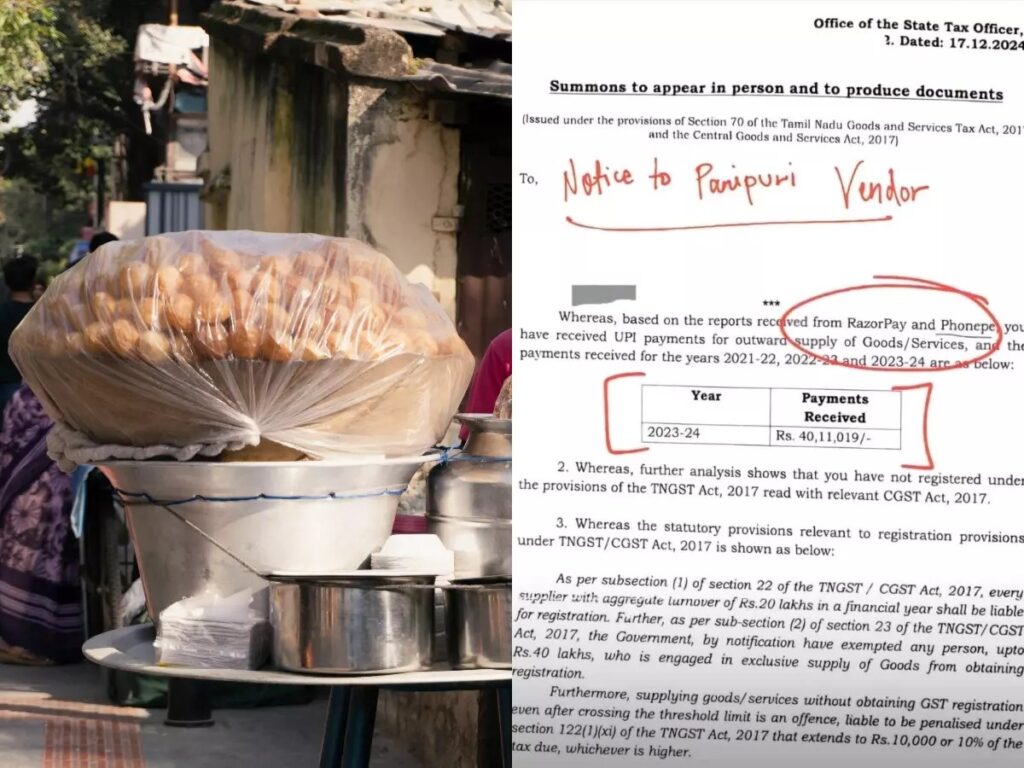

A notice to vendor, purportedly for receiving an online payment of ₹40 lakh in the year 2023-24, has gone viral on social media platforms. It has also sparked a debate on Reddit.

A summons dated December 17, 2024, which was issued under the provisions of section 70 of the Tamil Nadu good and service tax Act and Central GST Act, asked the vendor to appear in person and produce documents.

“Based on the reports received from razor pay and phone pay , you have received UPI payments for outward supply of goods/services, and the payments received for the years 2021-22, 2022-23 and 2023-24 are below,” reads the summons, showing ₹40 lakh received in 2023-24.

The notice also said that supplying goods/services without obtaining GST registration even after crossing the threshold limit is an offence.

ALSO READ ; ISRO NEW RECORD, Cowpea Seeds Germinated In Space .