What is REPO Rate ? RBI Repo Rate Cut History 2024 -2005 . The Repo Rate (stands for ‘Repurchase Agreement or Repurchasing Option’) is the interest rate at which the RBI (Reserve Bank of India) lends money to commercial banks in exchange for securities. It helps regulate liquidity and control inflation, and the current repo rate stands at 6.25% as of 7 February 2025.

| Effective Date | Repo Rate | %Change |

| 6 December 2024 | 6.50% | |

| 18 September 2024 | 6.50% | |

| 8 June 2023 | 6.50% | |

| 8 February 2023 | 6.50% | 0.25% |

| 7 December 2022 | 6.25% | 0.35% |

| 30 September 2022 | 5.90% | 0.5% |

| 5 August 2022 | 5.40% | 0.5% |

| 8 June 2022 | 4.90% | 0.5% |

| May 2022 | 4.40% | 0.4% |

| 09 Oct 2020 | 4.00% | 0.00% |

| 06 Aug 2020 | 4.00% | 0.00% |

| 22 May 2020 | 4.00% | 0.40% |

| 27 March 2020 | 4.40% | 0.75% |

| 6 February 2020 | 5.15% | 0.25% |

| 07 August 2019 | 5.40% | 0.35% |

| 06 June 2019 | 5.75% | 0.25% |

| 04 April 2019 | 6.00% | 0.25% |

| 07 February 2019 | 6.25% | 0.25% |

| 01 August 2018 | 6.50% | 0.25% |

| 06 June 2018 | 6.25% | 0.25% |

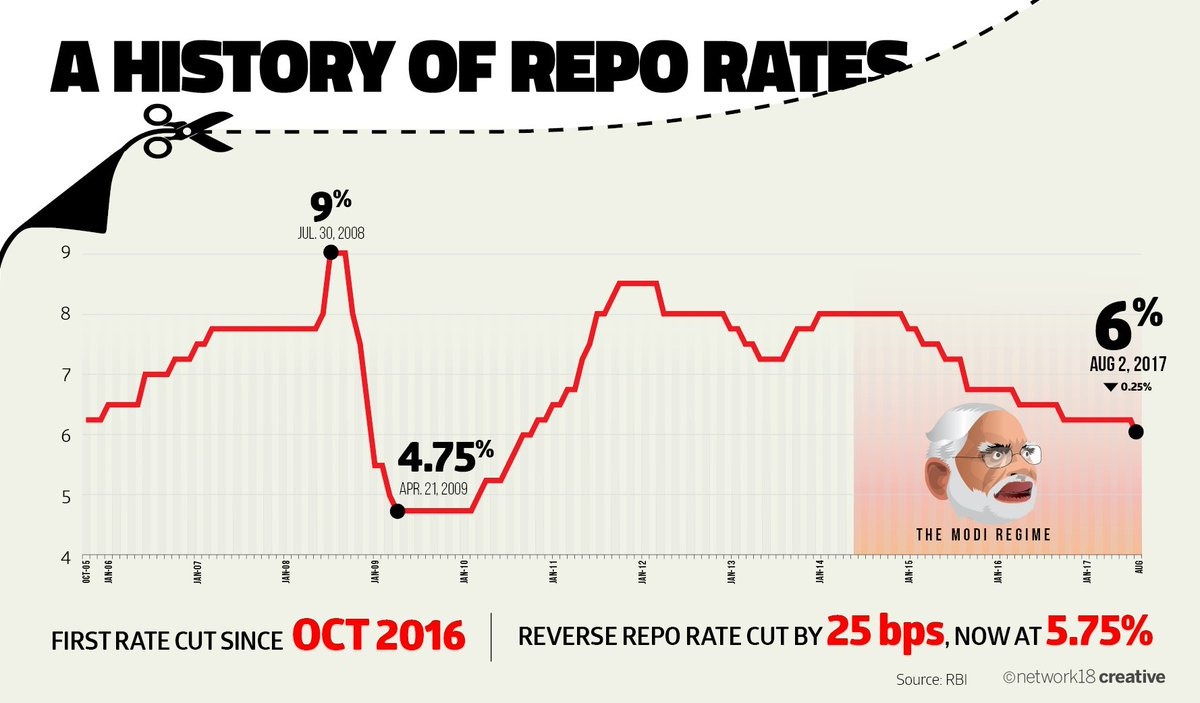

| 02 August 2017 | 6.00% | 0.25% |

| 04 October 2016 | 6.25% | 0.25% |

| 05 April 2016 | 6.50% | 0.25% |

| 29 September 2015 | 6.75% | 0.50% |

| 02 June 2015 | 7.25% | 0.25% |

| 04 March 2015 | 7.50% | 0.25% |

| 15 January 2015 | 7.75% | 0.25% |

| 28 January 2014 | 8.00% | -0.25% |

| 29 October 2013 | 7.75% | -0.25% |

| 20 September 2013 | 7.50% | -0.25% |

| 03 May 2013 | 7.25% | |

| 17 March 2011 | 6.75% | |

| 25 January 2011 | 6.50% | |

| 02 November 2010 | 6.25% | |

| 16 September 2010 | 6.00% | |

| 27 July 2010 | 5.75% | |

| 02 July 2010 | 5.50% | |

| 20 April 2010 | 5.50% | |

| 19 March 2010 | 5.00% | |

| 21 April 2009 | 4.75% | |

| 05 March 2009 | 5.00% | |

| 05 January 2009 | 5.50% | |

| 08 December 2008 | 6.50% | |

| 03 November 2008 | 7.50% | |

| 20 October 2008 | 8.00% | |

| 30 July 2008 | 9.00% | |

| 25 June 2008 | 8.50% | |

| 12 June 2008 | 8.00% | |

| 30 March 2007 | 7.75% | |

| 31 January 2007 | 7.50% | |

| 30 October 2006 | 7.25% | |

| 25 July 2006 | 7.00% | |

| 24 January 2006 | 6.50% | |

| 26 October 2005 | 6.25% | |

Repo rate increased 7 times since 2020

The reduction of 25 basis points in the repo rate has provided relief to the common man in the EMI of home loans, vehicle, personal loans. The central bank had last cut the policy interest rates in May 2020 during Covid. Then the repo rate was reduced to 4%. After this, the repo was increased 7 times, due to which it increased to 6.5%. There has been no change in the repo rate after February 2023.

How much will the EMI reduce

If someone has taken a home loan of Rs 50 lakh at an interest rate of 8.5% for 20 years and after the RBI announces a reduction of 0.25%, the EMI will be reduced substantially. At 8.5%, the monthly EMI that has to be paid is Rs 43,391, which after the reduction will become Rs 42,603 at the new interest rate of 8.25%, resulting in a saving of Rs 788 per month and Rs 9,456 per year. If a car loan of Rs 5 lakh is taken at 12%, then an EMI of Rs 11,282 has to be paid every month. If there is a reduction, the new EMI of the car loan will be Rs 11,149, resulting in a saving of Rs 133 per month and Rs 1,596 per year. Which sectors will benefit and which will suffer? Brokerage firm Morgan Stanley says that lenders with higher fixed rates will benefit from the reduction in interest rates.Unsecured lenders, vehicle-gold finance companies will benefit from this. However, brokerage firms believe that rate cuts may harm housing finance companies. At the same time, brokerage firm HSBC says that rate cuts are important in terms of liquidity, regulation and policy. Ease in liquidity and regulation will be positive for the market. Large NBFCs will benefit the most from the rate cut. However, government banks are not expected to benefit much.